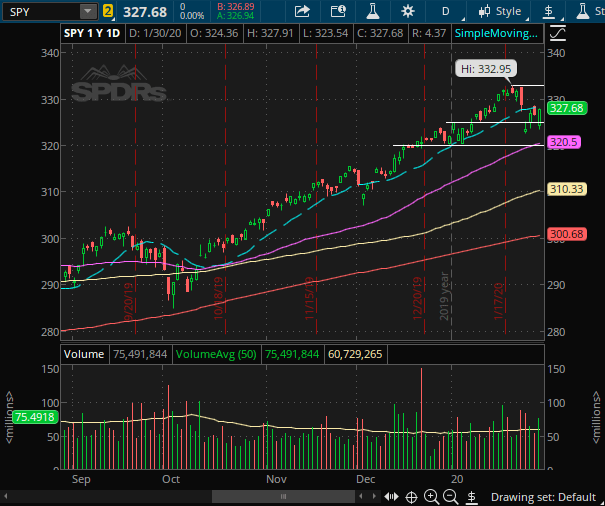

Yesterday the markets were choppy and range bound all day until an EOD ramp across the board. SPY had gapped down and stuck around the 325 level but then finally broke up and ripped through 326 to 328. This, like before, was a relief bounce upwards due to earnings anticipation. There is still great risk in overnight holdings as the virus continues to spread. Yesterday, the US confirmed the 6th case and first H2H transmission (the husband of the infected).

Volatility is still lingering with the VIX holding 16. As long as we are holding 16 there will be continued volatility risk and just outright choppiness in the market. It is tough to say but I predict that VIX sees another move over 18 and possibly to 20. The virus may not have an economic impact right now but if the 2nd largest economy is shutting down for a few weeks there will be noticeable repercussions. These will mostly be felt by companies with high China exposure (AAPL, MCD, SBUX, etc.). Again, it may not show for a little while but just know that what is occurring now probably will have negative repercussions on the markets.

The bombshell from earnings last night was AMZN reaching a high of 2133 in afterhours trading. It faded from the highs, gapped down a little, but is now ramping here premarket towards that 2100 level. For those who purchased 1950-2100 lotto calls they should easily be seeing $500 turn to $10,000 or $3,000 to $20,000 type moves. Congrats AMZN bulls, I bet Mackenzie Bezos is upset she just unloaded $400M worth of shares earlier this week…

As for the SPY, well, it is in limbo mode at the moment. Certainly, these levels offer a decent R/R for a dip buy but, in my opinion, there is still too much overnight and downside risk on the table. The virus is still spreading on a global scale and it seems to be extremely awful in Wuhan. Chinese officials have blocked all roads going in and out of the city with massive mounds of dirt. Hopefully China is giving us full disclosure with the numbers, but that is always a big question. For those unsure of what to do I recommend 2 things: (1) be patient and (2) do some historical research on what happened to global and US markets during both the swine flu and SARS epidemics.

Here are also a couple setups I suggest analyzing if you are looking for some plays. With VIX over 16 there continues to be more downside risk than upside potential. I would consider selling an SPY/SPX call spread for next Wednesday or Friday expiration at or above ATHs. With the virus going on it seems like we might not make ATHs anytime soon. Another setup I like is if SPY/SPX drops further to the 50MA (about SPY 320.50) support then I would look to sell a put spread as far out of the money and as far an expiration to your liking that still has at least a 1:4 R/R ratio. Lastly, if you are bullish long term despite the virus then look to buy in at these levels ¼ or ½ position and save room to add if we do get another big gap down towards that 50MA support. As soon as there is good virus news SPY will be back over 330 in a heartbeat!

Good luck and happy trading…