Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

Be yourself; Everyone else is already taken.

— Oscar Wilde.

This is the first post on my new blog. I’m just getting this new blog going, so stay tuned for more. Subscribe below to get notified when I post new updates.

The market has been dancing back and forth on virus blips but today it has gapped up strong to SPY 328. This can be attributed to some earnings as well as some positive virus blips. Cases are still climbing, mainly in mainland China, but there have been reports of a Russian drug that is going to be tried out for treatment. If this serves as a cure, then the market will go absolutely insane.

The poster child for the past few days has been TSLA, which has soared from 650 to 900 from Monday morning to premarket today. That is 250 points and +38% in just one and a half trading sessions. It seems that this thing is a 1000 missile so buckle up. But, because everyone wants to see it at 1000 don’t expect it to get there easily. TSLA has always been a trick name so best to be careful when playing both sides of this name. I highly recommend not shorting TSLA until we have a major blow off day. There is plenty of meat on the bone to the downside so be patient.

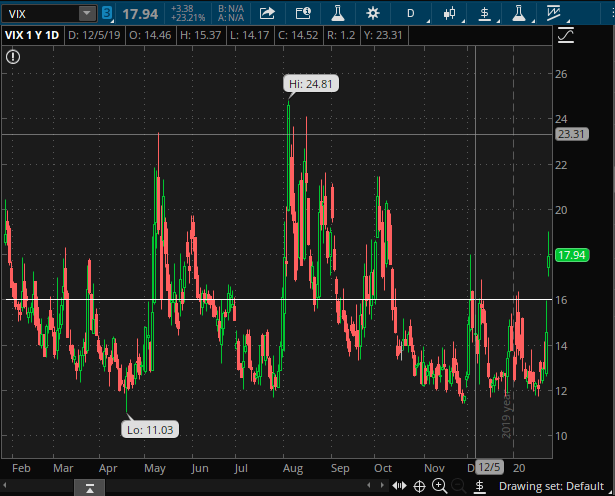

The VIX is still sucking on that 16 level and I presume it will until the virus slows down or a cure is found. I don’t expect this market to make new ATHs during the virus outbreak but you never know with this market…

For day traders I recommend focusing on TSLA to the long side. Be extremely patient and only take a set up if it is absolutely golden. Let the big washout slay the early longs before getting in. Also, if there is a big spike early then don’t chase. Let shorts get sucked in and then wait for it to set up again. Seeing 1000 run across the tape today would not surprise me. As for the entire market, a key level I am going to be watching is SPY 328.50. A clean break and push through 329 will get 330+. This move should coincide with the VIX sinking below 16 and fading. Another good name to watch with VIX is UVXY. VIX fading 16 should also result in UVXY going lower so watch for that, too.

My main focus today will be TSLA. I will be glued to the tape and also following the weekly options flow. Yesterday we saw some insane orders coming through the options market that foreshadow a move to 1000.

Good luck and happy trading…

For those of my readers who have investing accounts in addition to their trading accounts or solely see themselves as long term investors this is the article for you. I have compiled a list of stocks that pay monthly, yes MONTHLY, dividends for your holdings. There are a good number of monthly dividend names, but I have boiled down this list to the ones in which I feel are the safest and have the highest R/R in the longer term. Not only do I recommend these, I own shares with my own money in all the following. For these types of investments, I recommend only putting an amount of money that you are comfortable with writing off for at least 5-10 years. Investing in these names should be thought of as income generating as opposed to growth investing!

AGNC – AGNC Investment

AGNC Investment is an internally managed, real estate investment trust (REIT). From their website: “We invest predominately in agency residential mortgage-backed securities on a leveraged basis, financed primarily through collateralized borrowings structured as repurchase agreements.” AGNC was founded in 2008 and currently yields an annual dividend rate of 11.31%. Here is the AGNC chart since being founded in 2008.

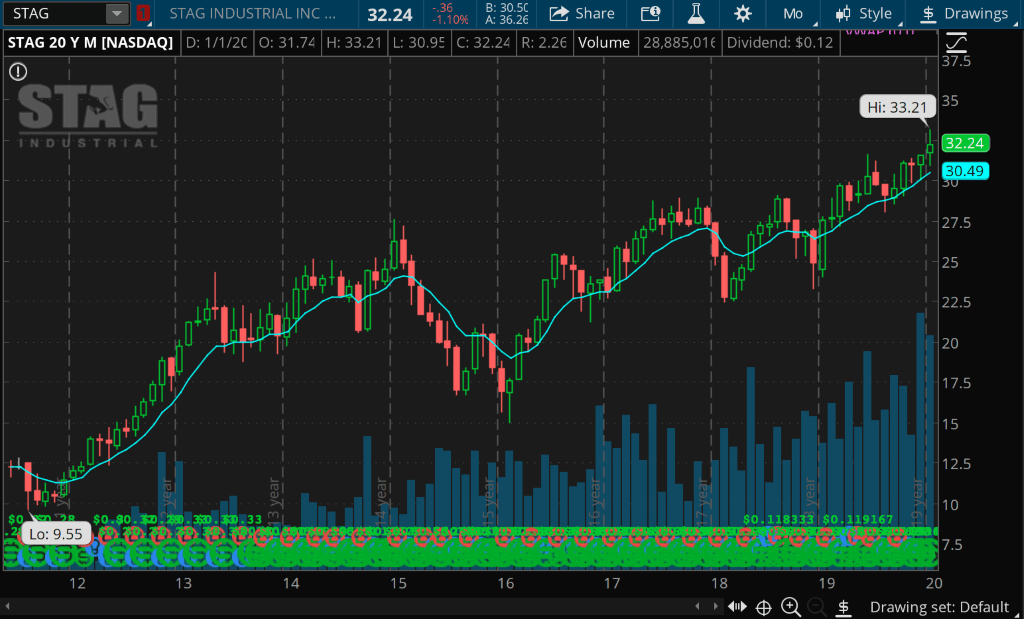

STAG – STAG Industrial

STAG Industrial is a real estate investment trust “focused on the acquisition and operation of single-tenant, industrial properties throughout the United States.” STAG was founded in 2010 and currently yields an annual dividend rate of 5.71%. Here is the STAG chart since being founded in 2010.

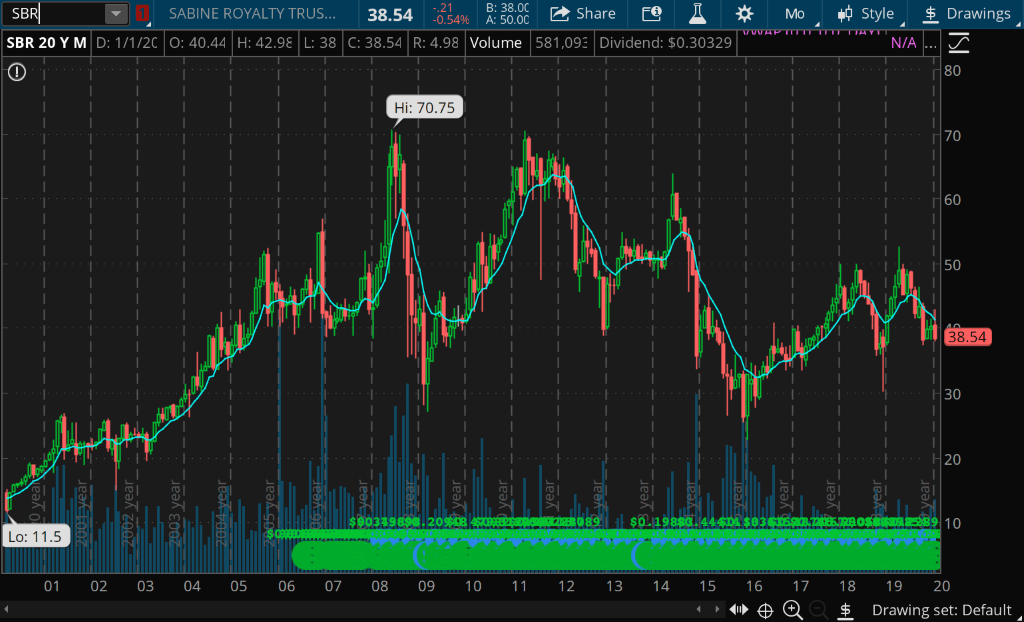

SBR – Sabine Royalty Trust

Sabine Royalty Trust is “an express trust. The Royalty Properties are the assets of the Trust. The Royalty Properties constitute interests in gross production of oil, gas and other minerals free of the costs of production.” SBR was founded in 1982 and is headquartered in Dallas, TX. SBR currently yields an annual dividend rate of 8.98%. Here is the chart for the last 20 years of SBR.

GWRS – Global Water

Global Water Resources is a water supply company founded in 2003 and headquartered in Phoenix, AZ. Global Water currently yields an annual dividend rate of 2.80%. Here is the chart for the performance of GWRS since IPO in 2016.

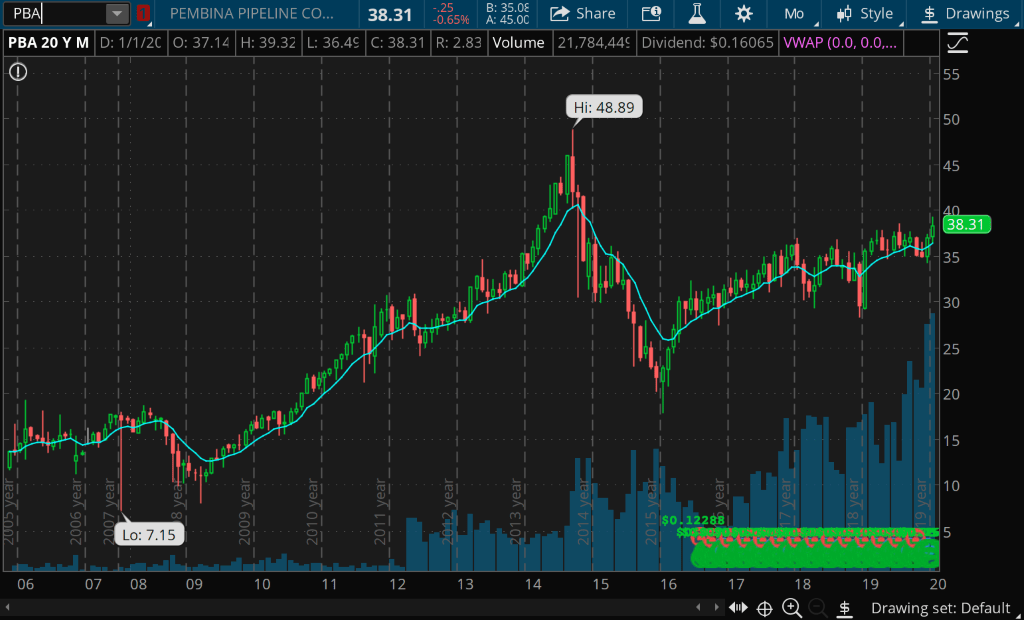

PBA – Pembina

Pembina “is a Canadian corporation that operates transportation and storage infrastructure delivering oil and natural gas to and from parts of Western Canada.” Pembina was founded in 1954 and is headquartered in Calgary, Canada. PBA currently yields an annual dividend rate of 5.83%. Here is the historical performance of PBA since IPO in 2005.

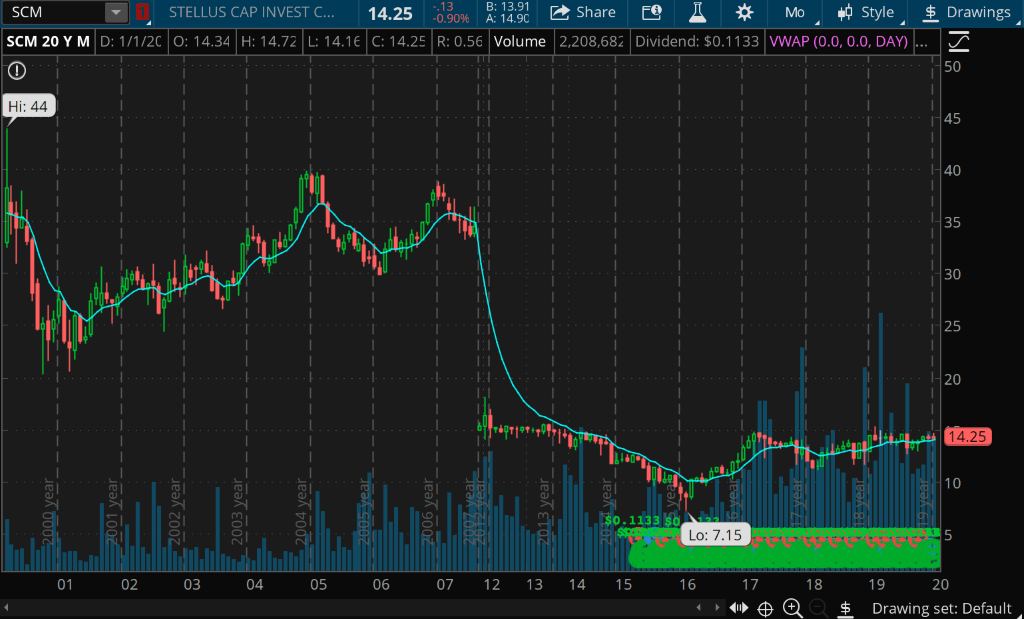

SCM – Stellus Capital Investment

Stellus Capital Investment is an investment from that focuses on “efficient and customized sources of private credit and energy-focused private equity capital to the middle market.” In other words, SCM focuses on investments in two places: a private credit platform and an energy platform. SCM was founded in 2012 and is headquartered in Houston, TX. SCM currently yields an annual dividend rate of 9.37%. Here is the chart for SCM over the past 20 years.

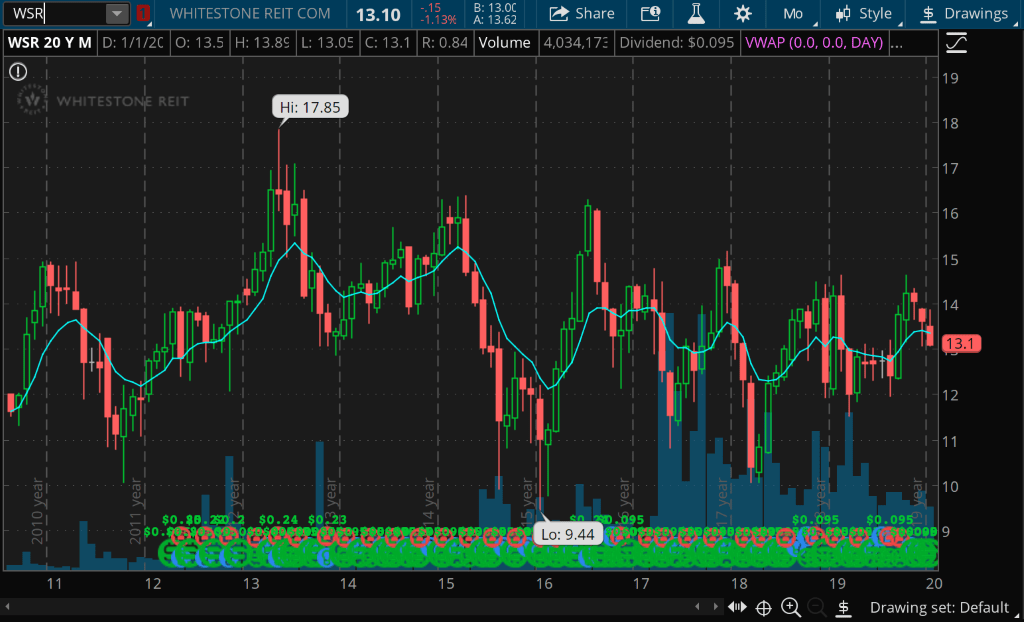

WSR – Whitestone REIT

Whitestone is another REIT that “acquires, owns, manages, develops and redevelops high quality “internet-resistant” neighborhood, community and lifestyle retail centers.” WSR was founded in 1998 and is headquartered in Houston, TX. WSR currently yields an annual dividend rate of 9.3%. Here is the chart for WSR since IPO in 2010.

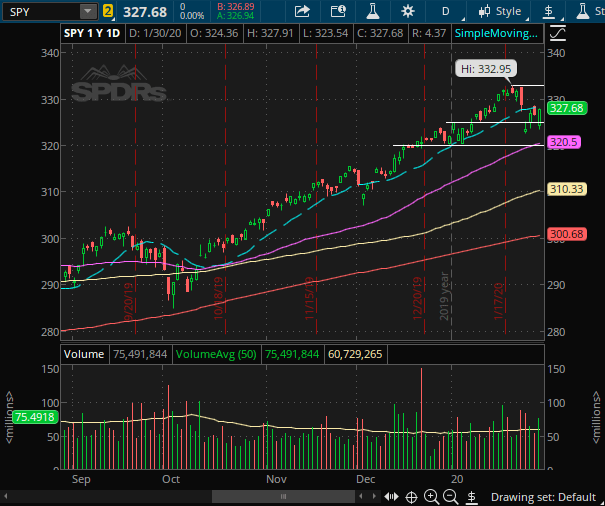

Yesterday the markets were choppy and range bound all day until an EOD ramp across the board. SPY had gapped down and stuck around the 325 level but then finally broke up and ripped through 326 to 328. This, like before, was a relief bounce upwards due to earnings anticipation. There is still great risk in overnight holdings as the virus continues to spread. Yesterday, the US confirmed the 6th case and first H2H transmission (the husband of the infected).

Volatility is still lingering with the VIX holding 16. As long as we are holding 16 there will be continued volatility risk and just outright choppiness in the market. It is tough to say but I predict that VIX sees another move over 18 and possibly to 20. The virus may not have an economic impact right now but if the 2nd largest economy is shutting down for a few weeks there will be noticeable repercussions. These will mostly be felt by companies with high China exposure (AAPL, MCD, SBUX, etc.). Again, it may not show for a little while but just know that what is occurring now probably will have negative repercussions on the markets.

The bombshell from earnings last night was AMZN reaching a high of 2133 in afterhours trading. It faded from the highs, gapped down a little, but is now ramping here premarket towards that 2100 level. For those who purchased 1950-2100 lotto calls they should easily be seeing $500 turn to $10,000 or $3,000 to $20,000 type moves. Congrats AMZN bulls, I bet Mackenzie Bezos is upset she just unloaded $400M worth of shares earlier this week…

As for the SPY, well, it is in limbo mode at the moment. Certainly, these levels offer a decent R/R for a dip buy but, in my opinion, there is still too much overnight and downside risk on the table. The virus is still spreading on a global scale and it seems to be extremely awful in Wuhan. Chinese officials have blocked all roads going in and out of the city with massive mounds of dirt. Hopefully China is giving us full disclosure with the numbers, but that is always a big question. For those unsure of what to do I recommend 2 things: (1) be patient and (2) do some historical research on what happened to global and US markets during both the swine flu and SARS epidemics.

Here are also a couple setups I suggest analyzing if you are looking for some plays. With VIX over 16 there continues to be more downside risk than upside potential. I would consider selling an SPY/SPX call spread for next Wednesday or Friday expiration at or above ATHs. With the virus going on it seems like we might not make ATHs anytime soon. Another setup I like is if SPY/SPX drops further to the 50MA (about SPY 320.50) support then I would look to sell a put spread as far out of the money and as far an expiration to your liking that still has at least a 1:4 R/R ratio. Lastly, if you are bullish long term despite the virus then look to buy in at these levels ¼ or ½ position and save room to add if we do get another big gap down towards that 50MA support. As soon as there is good virus news SPY will be back over 330 in a heartbeat!

Good luck and happy trading…

A lot has happened in the past 24 hours. Most notably, some big earnings, the Fed decision, and virus news. As for earnings, AAPL had a strong beat and resulting gap up. Not surprisingly, the AAPL chart almost exactly mimics the SPY chart from yesterday. TSLA reported last night and creamed shorts in an epic two stage move upwards. It hit a high of 660 after hours but is selling off now in premarket and looks like it will open in the 620-640 range. TSLA has become a total euphoria play now and has been so for weeks. Play carefully on both sides of it. Last night FB got crushed on its earnings and looks to open around 205 this morning. There are many other names that have reported but these are just a few of the highlights.

As for the Fed, they announced to keep rates unchanged. Status quo, I suppose. As always, they will continue to monitor the situation as they see fit. Not much else to report on there.

For virus related news, the number of infected and deaths keeps rising as predicted. I refrain from putting any numbers into this post because there is so much noise out there it is tough to tell what is true and what isn’t. All that really matters for the market is that the virus isn’t going anywhere soon. China has vowed to shut down business in many cities and many countries are considering travel bans to and from China. This will surely put a damper on global economics as well as the obvious China related names and transportation related names. Global futures are deep red across the world with China down 2%, Japan down 1.5%, and India down 1%. US markets gapped down premarket but remain the strongest of bunch.

Volatility is back and lingering as it should be. The VIX will be opening around 18 which isn’t quite as high as the gap up from Monday, but it is well over the key 16 level. The past few times we have seen a spike over 16 and hold we typically see more and bigger spikes to 20+. This means that there is great downside potential in equities and the indexes so increasing your portfolio to a greater cash position and putting hedges in place is a great idea. For hedging, I recommend GLD SLV TIP TLT and UVXY.

As for long swing trade setups I am typically running my scans to look for juicy opportunities, but there is too much risk right now for me to be interested. For now, I will weather the storm and manage hedges. My most recent win on a swing setup was SQ through the gap.

Another names I recommend keeping an eye on is JNJ. They have disclosed they are going full force at working on a corona virus vaccine. They were open about it taking up to 6-12 months as they are starting from scratch. To compare, when they worked on the swine flu vaccine it only took them 6 months, but they already had the precise strain to work from. Unfortunately, they do not have this for the corona virus right now so they must start from scratch.

As for overall sentiment, it feels that PMs are long but weary. We saw the dip get bought up from Monday into Tuesday, but this was more of a technical relief bounce to the 15MA than anything else. SPY is now dancing with the 325 level again and I assume we will stay there until the next major headline is released. Assuming the virus headlines won’t be getting any better quickly, look to trade SPY to the downside with a break through 324 to targets 320 (50MA) and 318.

Good luck and happy trading…

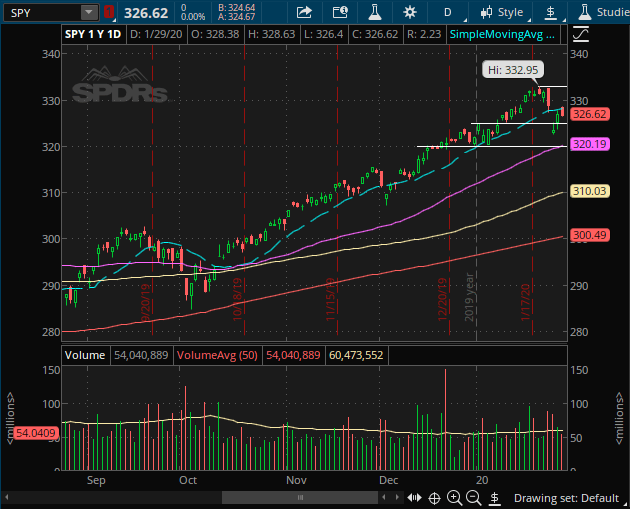

Price action yesterday was indicative of news digestion. This bid was tested across the board and most names held up. There was not any urgent or major selling pressure yesterday and I assume that will likely be the case today, too. More corona virus cases and deaths will be reported each day but what’s important is the rate of change from day to day. This will tell us whether we are accelerating or decelerating, and how fast.

This is a big earnings week and there is also a Fed announcement Wednesday at 2pm. Until then, expect the market to be choppy and sit on some cash to see which way things swing. Earnings are expected to be good, but they will have to really crush expectations for a continued move higher in most names.

The SPY was range bound yesterday from 322.50 to 325. This morning we have broken above that key 325 level. If we stay strongly above SPY 325 and dips are being bought up, then I suspect a 326 breakout will get us back to 328 sometime this week. As for downside targets, SPY 320 makes logical retracement sense but as we all know trading the downside in this market is next to impossible as it would likely be a gap down move to get us there. In my opinion, it is best to hedge a small percentage of your account in gold names or bear ETF names for the short term. The corona virus isn’t going anywhere fast, but the market doesn’t seem too concerned about its impact (for now).

For day traders, I recommend waiting for SPY to break yesterday’s range before making any trades. Use that range as your guide for sentiment. For swing traders and investors, I recommend having a small hedge position or two until the correction is over and the virus hysteria has calmed down. Also, with the Fed announcement and many earnings this week I recommend it is a good time to be sitting on some cash for the next big opportunity.

The VIX has already begun fading yesterday’s spike and looks like it is headed back down to test the key 16 level. Be ready for a spike or fade off 16. If we fade 16 then it will be a good time to scoop some longs assuming no Fed or earnings risk is imminent.

Be patient, the correction may not be over just yet.

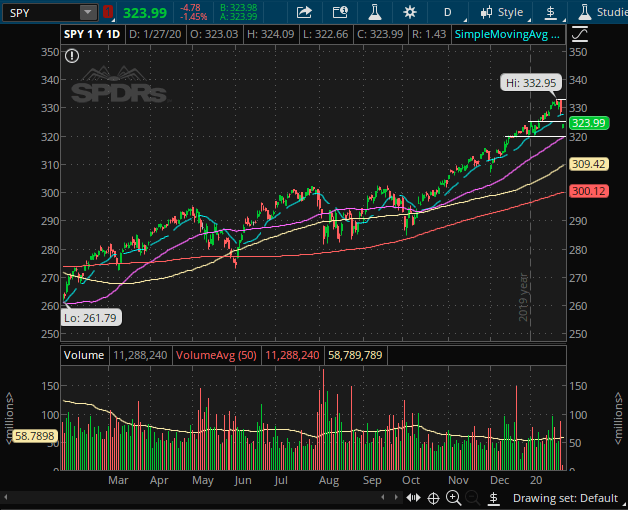

Over the weekend there have been more confirmed cases of the Wuhan coronavirus spreading. China is claiming a higher infection toll and higher death toll every day proving an acceleration of the spreading. Is this a global pandemic yet? No. Does it have the potential to be a global pandemic? Yes. All we know as of now is that there is currently no cure and that the virus is still spreading despite China’s countermeasures. Many cities in China are under travel ban but this comes at a tough time during the Lunar New Year when many Chinese are travelling about to gather with family.

This week is a big earnings week with many top names reporting (AAPL, TSLA, AMD, AMZN, MSFT, and many more). Earnings are expected to be good but this uptick in volatility and downshift in the market will be a grey cloud for some time. Companies with heavy China exposure will have a tough time on guidance for the coming quarters/year as there is uncertainty surrounding the Chinese economy and workforce. As we know, many US companies source a lot of manufacturing from China so the virus could weigh on future guidance.

SPY has blown through the 15MA (teal line) and is nearing the key 50MA (purple line) at 319.20. Look for the bid to be tested early and continued weakness at the open and throughout the day. The coronavirus will act as a grey cloud indefinitely until we start to see a decrease in the confirmed cases and death toll numbers.

Volatility has been brought back to the market with the VIX shooting over the key 16 level. Nearly every time the VIX has shot over 16 an ugly market has been triggered and this should be no different. Look for a fade towards VIX 16 and then see if it breaks down or holds. If VIX stays over 16 look for a continued ugly market and further spikes to 20+. UVXY and VXX other volatility names to keep an eye on with VIX.

One final thought I will leave with you before you go BTD this morning: we are potentially seeing the start to a global pandemic virus in one of the most highly levered markets in history…

Cash is a position, too.

This is an example post, originally published as part of Blogging University. Enroll in one of our ten programs, and start your blog right.

You’re going to publish a post today. Don’t worry about how your blog looks. Don’t worry if you haven’t given it a name yet, or you’re feeling overwhelmed. Just click the “New Post” button, and tell us why you’re here.

Why do this?

The post can be short or long, a personal intro to your life or a bloggy mission statement, a manifesto for the future or a simple outline of your the types of things you hope to publish.

To help you get started, here are a few questions:

You’re not locked into any of this; one of the wonderful things about blogs is how they constantly evolve as we learn, grow, and interact with one another — but it’s good to know where and why you started, and articulating your goals may just give you a few other post ideas.

Can’t think how to get started? Just write the first thing that pops into your head. Anne Lamott, author of a book on writing we love, says that you need to give yourself permission to write a “crappy first draft”. Anne makes a great point — just start writing, and worry about editing it later.

When you’re ready to publish, give your post three to five tags that describe your blog’s focus — writing, photography, fiction, parenting, food, cars, movies, sports, whatever. These tags will help others who care about your topics find you in the Reader. Make sure one of the tags is “zerotohero,” so other new bloggers can find you, too.